Increase in Us Beef Exports to Argentina and Brazil

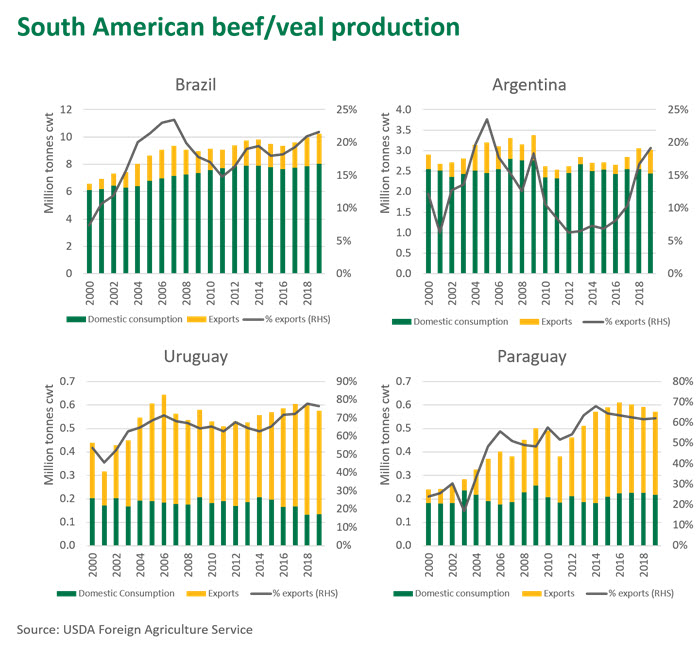

South America continues to build momentum, with improving market access, growing herds and undervalued currency favouring exports. These weather will keep to support beef consign growth from South America off the back of a strong start to 2019.

Year-to-July beefiness exports from the big four S American producers (Brazil, Argentina, Paraguay and Uruguay) have surpassed 2018 levels, currently sitting just to a higher place 1.4 meg tonnes and tracking eighteen% higher up last yr.

China has clearly gained precedence, with the majority of exports pivoting away from Russia, the regions traditional partner. Twelvemonth-to-July beef exports to China currently sit just under 500,000 tonnes, upwards 37% on a year-ago and accounting for 35% of total exports from Southward America, where only 5 years ago this effigy was five%. Need is expected to go on edifice heading into the Chinese New year in Jan 2020 as African Swine Fever bites into protein supply. Because the stiff global demand for animal poly peptide and the low value of the Argentine Peso and Brazilian Real relative to the US dollar, South American exports are expected to continue growing.

Despite increasing contest from other nations, Australia withal maintains its status as a loftier-quality and reliable beef producer. As big South American countries proceed to build marketplace share through product gains and new merchandise relationships, information technology is important to proceed analysing how their contribution to the global beef market will touch Australia moving forward.

Marketplace highlights:

Brazil

- Year-to-July exports up 22% on 2018

- Global and domestic pressure weakens the Brazilian real but no recession even so.

Brazil has recently had some big market access wins, concluding calendar month reaching an understanding to supply Republic of indonesia with l,000 tonnes over the next 12 months (as discussed terminal week), and a beneficiary of the Mercosur-EU trade deal, negotiations of which concluded in June. Notwithstanding, the deal still needs to be ratified by both sides' parliaments and, complicating things further, has recently received push back from Ireland regarding the clearing of Amazon rainforest for farmland.

For the yr-to-July, Brazilian global beef exports accept reached 810,000 tonnes swt. Shipments to Red china were up 11% on 2018, which is relatively pocket-size when compared to its Argentine (up 103%) and Uruguayan (up 35%) neighbours, who have had the bulk of their product snapped up by China. Meanwhile, Brazilian shipments to Hong Kong are downward ten%, greatly affected by higher costs through the grey aqueduct. Reports suggest Chinese interest in Brazilian beef is growing, and college shipments are expected for Baronial. This interest has been verified with the recent Chinese approval of 17 beefiness processing plants in Brazil for consign.

Beef production throughout Brazil continues to increment, with investments leading to improved production efficiency, disease direction, and supply chain traceability. Since the first of the millennium, Brazil has increased its beefiness production past 55%, or a staggering 3.7 million tonnes. Much of these production gains tin be attributed to the increase in the size of their national herd, growing by almost 17 million head over the course of 20 years.

Argentina

- Year-to-July exports up 44%

- Cow slaughter has been running above yr agone levels as strong export prices and local financial pressures have encouraged producers to cull herds.

The current economic state of affairs in Argentina is fragile and frail, with ongoing uncertainty regarding elections. After Mauricio Macrio lost the first round of elections earlier in August, the Argentine Peso has lost 25% of its value relative to the U.S dollar. With high levels of aggrandizement and the Argentine Peso at a celebrated low, Argentina is sitting at the brink of a financial crisis. The depression value of the Peso will go on to brand Argentina an attractive supply source for China, while higher levels of inflation will likely boring local beefiness consumption through 2019.

While Argentina has been granted access to the U.s., shipments there take been minimal due to the stiff demand from China. There is a growing dependence on China, which has deemed for 73% of Argentine beef exports this yr (195,000 tonnes swt of a total 265,000 tonnes swt).

High involvement rates have made business conditions tricky for farmers, with the Argentine cattle herd potentially dropping 400 thousand head side by side year (cows represented 50.i% of slaughter for the start half of the year).

Uruguay

- Year-to-July exports up 6%

- Potent prices take encouraged liquidation

- Beef production has increased by 137% since 2000.

Uruguay has strongly positioned itself within the market for grass-fed beefiness, underpinned by strict germ-free standards and excellent transparency forth their supply chain. Uruguay is targeting the Communist china market past increasing branding and marketing initiatives, in particular through the southern regions. Current exports for the year-to-July sit at 195,000 tonnes swt, with 68% of this heading to Red china. With access into a number of key markets (namely the United states, Cathay and the European union), Uruguay are a strategic competitor for Commonwealth of australia, but exports are limited by a relatively small-scale supply base.

For virtually of 2019 slaughter levels have been sitting above the five year average as high prices have encouraged liquidation. Lower cattle inventories and improving atmospheric condition and feed conditions have slowed slaughter through winter, with August figures downward 3,000 head on the same calendar week last twelvemonth.

Paraguay

- Year-to-July exports downwards xiv%

- Possible recession looming.

2019 has been a challenging year for Paraguay, with flooding in March and May slowing sales, declining cattle prices and a fire at 1 of the largest meat packing plants reducing slaughter cattle need. Year-to-July exports sit at 130,000 tonnes swt, with the bulk of this beef heading to Russia and other destinations around S America. A projected increase in beef product and slow domestic consumption should lead to a revival of beefiness exports next yr. Cattle slaughter picked up by 2% in August, which peradventure indicates improved slaughter numbers for the second half of the year.

© Meat & Livestock Australia Express, 2019

Source: https://www.mla.com.au/prices-markets/market-news/2019/beef-exports-exceptional-for-south-america/

0 Response to "Increase in Us Beef Exports to Argentina and Brazil"

Post a Comment